“If African leaders (in or out of power) will adopt the “why” curiosity en masse and apply it to every area of the socio-economic-political landscape of their countries, the issue of unnecessary poverty and irrational conflict will disappear within two generations; because “why” curiosity will lift the veil of existential darkness, obliterate systemic blindness and usher a magnificent light into the affairs of African countries and their peoples.”

In another post on this website, I postulated a theory of existence of a syndrome that I referred to as “Systemic blindness” and that it was largely responsible for the inability of many Africa countries to evolve more successful socio-economic-political arrangements. It is applicable to creativity as well and hence relevant to this discussion. In “systemic blindness,” people (especially the leaders) in a given environment survey the dysfunction of their environment and determine that because it is country X and it has always been that way, that that is the way it is supposed to function or exist. In other words, that the existential environment and reality of country X is calcified beyond corrective measures and is as a result, a permanent state. That determination prevails in the consciousness in spite of known examples of contrary experience in country A, that is doing the same things, but doing them differently and has a more functional socio-economic-political environment as a result. “Systemic blindness” syndrome is aided and ably abetted by lack of curiosity and the power of “why?” Why should it be that way? Who is doing it better and why? And what can we learn from them?“Why?” curiosity has its own capacity to pull down negative strongholds and rectify wrong thinking in people and society. If African leaders (in or out of power) will adopt the “why” curiosity en masse and apply it to every area of the socio-economic-political landscape of their countries, the issue of unnecessary poverty and irrational conflict will diminish within two generations; because “why” curiosity will lift the veil of existential darkness, obliterate systemic blindness and usher a magnificent light into the affairs of Africa countries and their peoples.

In another post on this website, I postulated a theory of existence of a syndrome that I referred to as “Systemic blindness” and that it was largely responsible for the inability of many Africa countries to evolve more successful socio-economic-political arrangements. It is applicable to creativity as well and hence relevant to this discussion. In “systemic blindness,” people (especially the leaders) in a given environment survey the dysfunction of their environment and determine that because it is country X and it has always been that way, that that is the way it is supposed to function or exist. In other words, that the existential environment and reality of country X is calcified beyond corrective measures and is as a result, a permanent state. That determination prevails in the consciousness in spite of known examples of contrary experience in country A, that is doing the same things, but doing them differently and has a more functional socio-economic-political environment as a result. “Systemic blindness” syndrome is aided and ably abetted by lack of curiosity and the power of “why?” Why should it be that way? Who is doing it better and why? And what can we learn from them?“Why?” curiosity has its own capacity to pull down negative strongholds and rectify wrong thinking in people and society. If African leaders (in or out of power) will adopt the “why” curiosity en masse and apply it to every area of the socio-economic-political landscape of their countries, the issue of unnecessary poverty and irrational conflict will diminish within two generations; because “why” curiosity will lift the veil of existential darkness, obliterate systemic blindness and usher a magnificent light into the affairs of Africa countries and their peoples.

The first part of this discussion examines the existing structure of high capital intensive projects executed in African countries and why, save for a very few countries, the benefits are not maximized. The highlight of the latter half is a model transaction designed to profile the type of transactions that Africa countries can deploy among other techniques, including structured projects and finance, to begin to increase the flow of infrastructure projects into their countries. Projects that will not only alleviate capital-repulsing structural deficiencies in their economies but also enable more resources expended for such projects to be retained in the local economy and the achievement of greater proportion of technological transfers to ensure that future supplies to such projects will be from local sources.

Maximizing the Benefits of Infrastructure Projects

Infrastructure development is recognized as a good stimulus plan for national economies. Building roads, Power Plants, Railway lines, etc., are great means of boosting jobs growth and economic activity. Contractors awarded the project hire local labor and buy local materials. The beneficiaries of the business largess repeat the same process in order to get feedstock needed to meet the demand from contractors. Workers who gain employment have money to spend in the marketplace for their individual and family needs. On and on it goes, setting-off a crescendo of economic and financial domino effect that is felt all the way down the food and earnings chain of the economy. As such, infrastructure development projects have been a secure path to ushering in long term economic growth for many countries around the world. Like with every rule or pattern, there is an exception. The exception to the rule that infrastructure development is a good economic stimulus plan seems to be found in African countries.There are very fundamental reasons for why the benefits of infrastructure development are not felt to the extent in African countries as in other areas of the world. The main reason is that the factors that go into infrastructure development projects in African countries are not the same as in other countries.

Infrastructure development is recognized as a good stimulus plan for national economies. Building roads, Power Plants, Railway lines, etc., are great means of boosting jobs growth and economic activity. Contractors awarded the project hire local labor and buy local materials. The beneficiaries of the business largess repeat the same process in order to get feedstock needed to meet the demand from contractors. Workers who gain employment have money to spend in the marketplace for their individual and family needs. On and on it goes, setting-off a crescendo of economic and financial domino effect that is felt all the way down the food and earnings chain of the economy. As such, infrastructure development projects have been a secure path to ushering in long term economic growth for many countries around the world. Like with every rule or pattern, there is an exception. The exception to the rule that infrastructure development is a good economic stimulus plan seems to be found in African countries.There are very fundamental reasons for why the benefits of infrastructure development are not felt to the extent in African countries as in other areas of the world. The main reason is that the factors that go into infrastructure development projects in African countries are not the same as in other countries.

In African countries, the prime contractor for infrastructure projects, in most cases, is not indigenous to the country that is developing the project. This invariably means that their fee, baring special dispensation, is paid in convertible currency. As a result, the fee does not circulate in the economy of the project country and instead circulates in the economy of the home country of the constructor. This removes a large chunk of the funds that pay for such projects from the country that has assumed debt liability of funding for the project. The equipment supplied is invariably foreign in origin in virtually every case. This removes the second biggest opportunity of financial benefit away from the project country.

Much more consequential than the initial supply of equipment is supply of replacement parts needed to maintain the project. The lack of local spare parts fabrication capability relegates the project to depending on importation of replacement parts in order to function uninterrupted. In many cases because the flow of hard currency into the treasuries of most countries is ad hoc and unpredictable, any project that depends on hard currency flow from the national treasury often find their needs unmet and as a result, valuable capital resources expended to create the project in the first place is jeopardized. When a given project, and there have been countless examples in African countries, reaches this stage of dismemberment, it is not the loss of jobs, or anticipated goods or all the other effects of a business that has reached the end of its existence that the country has to contend with. To add insult to injury, there also remains the unpaid debt to be serviced without attendant revenues from the venture. The third leg is high-level management labor. Because the prime contractor and equipment supplier are almost always foreign entities or entities controlled by non-indigenes of the country or even of another African country, the managers of the project invariably will also be foreign and their salaries paid to them in hard currency. The sum of these anomalies is that African countries unlike other countries are unable to enjoy the maximum economic multiplier effect of debt-funded infrastructure projects.

Insufficient Indigenous Constructors in African Countries

The biggest challenge facing African countries, is to develop indigenous enterprises in every facet of infrastructure development. I am not referring to the front companies created by installing a puppet at the helm of a foreign entity simply to pass the threshold demanded by some countries, that indigenes have to have majority control of local enterprises. The rule is ineffective and has not led to creation of a true entrepreneurial class in any country that uses it. In fact it is actually a retardant to developing an entrepreneurial class because it offers the illusion of economic control and self-determination. A sort of “we are participating so all must be well state” of mind. When in fact the opposite is what is occurring. The participation is on the fringes and lacks true decision and ownership making power. It has been around for more than 30 years in some cases and 40 years in others and African countries are still largely by-standers in the core economic life of their countries. It is akin to someone who owns a car but cannot drive it because someone else owns the engine and steering wheel. The lack of true economic control over their economies is why, sadly, decades after independence, African countries are still largely exporters of raw materials and importers of everything else. Apparently, it is only administrators of African countries that are ignorant of the fact that the raw materials they are exporting constitute the bottom of the income (food) chain. The real money, real income, is in the value added processing of the raw materials. Absurdly, some countries have to import the finished goods produced from the very raw materials they exported. How crazy is that arrangement? Why would any person of lucid faculties put the economic and social welfare of his or her country and people in that situation?

The biggest challenge facing African countries, is to develop indigenous enterprises in every facet of infrastructure development. I am not referring to the front companies created by installing a puppet at the helm of a foreign entity simply to pass the threshold demanded by some countries, that indigenes have to have majority control of local enterprises. The rule is ineffective and has not led to creation of a true entrepreneurial class in any country that uses it. In fact it is actually a retardant to developing an entrepreneurial class because it offers the illusion of economic control and self-determination. A sort of “we are participating so all must be well state” of mind. When in fact the opposite is what is occurring. The participation is on the fringes and lacks true decision and ownership making power. It has been around for more than 30 years in some cases and 40 years in others and African countries are still largely by-standers in the core economic life of their countries. It is akin to someone who owns a car but cannot drive it because someone else owns the engine and steering wheel. The lack of true economic control over their economies is why, sadly, decades after independence, African countries are still largely exporters of raw materials and importers of everything else. Apparently, it is only administrators of African countries that are ignorant of the fact that the raw materials they are exporting constitute the bottom of the income (food) chain. The real money, real income, is in the value added processing of the raw materials. Absurdly, some countries have to import the finished goods produced from the very raw materials they exported. How crazy is that arrangement? Why would any person of lucid faculties put the economic and social welfare of his or her country and people in that situation?

Lack of substantive local participation in core infrastructure development; lack of an entrepreneurial class that responds to demand-mandates in the society; lack of creativity in strategic resource deployment; lack of industrial export manufacturing and processing capacity; are core contributory factors to the underlying cause of why African countries are unable to extricate their societies from the grip of poverty, despite a sustained period of extraordinarily high commodity prices. The fruit of crony-capitalism syndrome is that a few families and people have attained vast wealthy at the expense of the larger population and the future welfare of the country. The results bear out its ineffectiveness. Instead, governments should change direction and give foreigners and indigenes the same opportunity to start enterprises without encumbering rules. However, governments are responsible through indigenous enterprise promotion policies for ensuring that it discriminates in favor of indigenously owned and managed local companies in the award of contracts. It should be viewed in the light of a necessary rational accountability measure to ensure that Kenyans are building the roads and bridges in Kenya; that Ghanaians are contributing significantly to building the Power plants in Ghana; and Nigerians are building parts needed to keep their oil refineries working. It (the government) is also responsible for developing as well as incentivizing its indigenous entrepreneurial class to take on the task of developing enterprises that can respond to demand mandates in every area of the local economy. In the development of South Korea, Park Chung Hee was brilliant in co-opting the business and entrepreneurial class and in effect outsourcing economic development objectives of South Korea to them. That is the fruits of making a determined and purposeful effort to build the entrepreneurial class. There were some bumps in the road but in the main, the strategy paid off handsomely for South Korea. That is why South Koreans, by and large, own the economy of their country.

Bridging the Creativity Gap in African Countries

There is a creativity gap as well. The creativity gap is the reason why few innovations start in African countries. If necessity is the mother of invention and there is a great ocean-gaping void of prosperity need in African countries, why has the mother of invention not produced many innovative solutions to the poverty quotient of almost every Africa country? The simple answer is that the “dam” of competitive ineptitude constructed by “decisioniers” of African countries, has successfully sabotaged the creative capacity of the mother of invention. The “dam”has made it very difficult to introduce ideas into the collective consciousness of African people. Ideas masquerading as solutions that if allowed to bubble-up into society’s consciousness, will naturally and effectively drown the dessert of poverty in a cascading watershed of prosperity. That damming is the core target of this discussion. It is not that there are no sufficiently creative people or sufficient resources in African countries. The crux of the problem of lack of creativity is the inability of those who are leading to see the effectiveness of leading by staying out of the way. To ensure that they are maximizing the inherent resources reposed in their people by enabling the creative capacity of; businesses, financial engineers and entrepreneurial geniuses in their midst, to flourish to the greater good of society.

There is a creativity gap as well. The creativity gap is the reason why few innovations start in African countries. If necessity is the mother of invention and there is a great ocean-gaping void of prosperity need in African countries, why has the mother of invention not produced many innovative solutions to the poverty quotient of almost every Africa country? The simple answer is that the “dam” of competitive ineptitude constructed by “decisioniers” of African countries, has successfully sabotaged the creative capacity of the mother of invention. The “dam”has made it very difficult to introduce ideas into the collective consciousness of African people. Ideas masquerading as solutions that if allowed to bubble-up into society’s consciousness, will naturally and effectively drown the dessert of poverty in a cascading watershed of prosperity. That damming is the core target of this discussion. It is not that there are no sufficiently creative people or sufficient resources in African countries. The crux of the problem of lack of creativity is the inability of those who are leading to see the effectiveness of leading by staying out of the way. To ensure that they are maximizing the inherent resources reposed in their people by enabling the creative capacity of; businesses, financial engineers and entrepreneurial geniuses in their midst, to flourish to the greater good of society.

A Model Transaction for Mass-Transit and other Infrastructure Projects

One of the biggest challenges that many countries face is transportation infrastructure. It is also one of the areas in which transactional creativity and financial engineering can have a decidedly positively impact in every country. An outside-the-box innovative approach can overcome the primary challenges in the path of executing high capital and technologically intensive transportation schemes. There is a very large advantage inherent in transportation and other infrastructure projects. It is in the business reality that the high capital requirement makes them attractive to global transactional and financial geniuses. I refer to them as “deal-making whales”. If the deal is big enough predictably the “whales” will come out to play. The challenges impeding rapid flow of capital and hence projects are: (1) Access to capital to finance the project; (2) construction expertise; (3) source of equipment and materials; (4) long-term source of replacement parts; (5) and market-driven pricing structure that will ensure profitability. Market-driven pricing, which is controlled by the executing country, is the life-blood of the eventual enterprise. Irrespective of the role that government plays in creating the enterprise, the cost of debt-service and operations mandate that the modelling of revenue streams be driven by real-time market forecasting. As long as infrastructure projects are managed strictly as commercial ventures in which the government may or may not have a shareholding interest, countries will find all the money they need. It only requires one large-scale operating success story to change historical dynamics of fund flows into Africa countries’ infrastructure deals. Emergence of an operating success story will be the belling of the cat for the global financial industry and cause notice to be taken and positive rays shone on the profit and good ROI opportunity of infrastructure deals in Africa countries.

One of the biggest challenges that many countries face is transportation infrastructure. It is also one of the areas in which transactional creativity and financial engineering can have a decidedly positively impact in every country. An outside-the-box innovative approach can overcome the primary challenges in the path of executing high capital and technologically intensive transportation schemes. There is a very large advantage inherent in transportation and other infrastructure projects. It is in the business reality that the high capital requirement makes them attractive to global transactional and financial geniuses. I refer to them as “deal-making whales”. If the deal is big enough predictably the “whales” will come out to play. The challenges impeding rapid flow of capital and hence projects are: (1) Access to capital to finance the project; (2) construction expertise; (3) source of equipment and materials; (4) long-term source of replacement parts; (5) and market-driven pricing structure that will ensure profitability. Market-driven pricing, which is controlled by the executing country, is the life-blood of the eventual enterprise. Irrespective of the role that government plays in creating the enterprise, the cost of debt-service and operations mandate that the modelling of revenue streams be driven by real-time market forecasting. As long as infrastructure projects are managed strictly as commercial ventures in which the government may or may not have a shareholding interest, countries will find all the money they need. It only requires one large-scale operating success story to change historical dynamics of fund flows into Africa countries’ infrastructure deals. Emergence of an operating success story will be the belling of the cat for the global financial industry and cause notice to be taken and positive rays shone on the profit and good ROI opportunity of infrastructure deals in Africa countries.

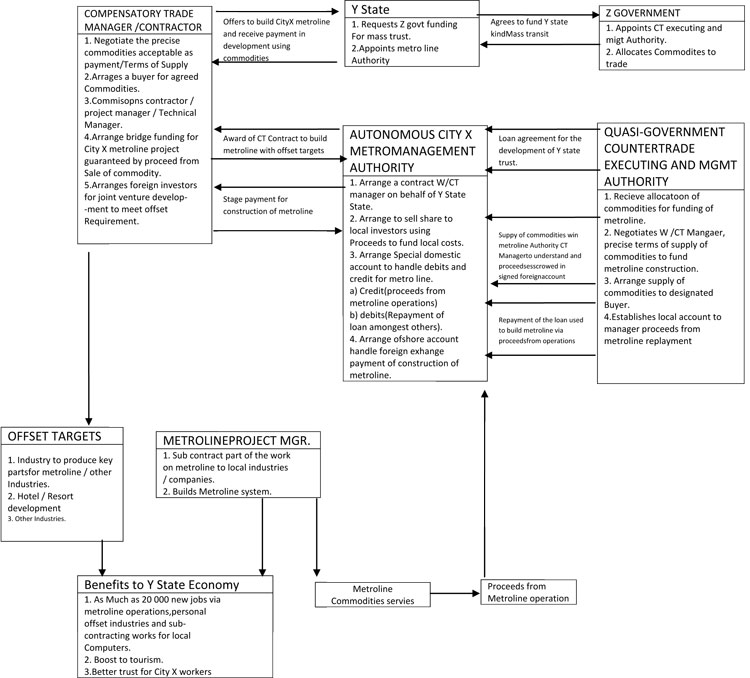

In the light of the foregoing, the following transactional model attempts to answer the challenges while addressing the critical importance of constricting outflow of hard currency resources. It also addresses through a matrix of contractual requirements the critical need to ensure that large projects achieve the maximum possible multipliers in the local economy and creates a manufacturing and processing foundation that ensures less dependence on imports for replacement parts in the future of the operating entity. A transaction with such contingencies in the contractual matrix will be much more bankable in the eyes of the financial community of bond facilitators, investors and equity holders.

Transaction Profile

City X, in Y State, located in Z country, has major traffic challenges due to vast increase in the commercial activities of the city, state and attendant increase in influx of people. Population has vastly expanded and as a result, traffic has become virtually unmanageable. Y state wants to build a mass-transit system but needs the cooperation of Z country’s government. Z government has the option of using a basket of export commodities to finance the project. Y state will require city X to institute a local tax in addition to revenues generated from operations that will be used to repay the national treasury of Z Government. The advantage of this project is that the project will only require a bridge funding because the guaranteed contract to supply commodities to external parties who will be paying in hard currency, will act as indemnificatory mechanism for external funding.

Qualifications

The project is intended as a profit-oriented development initiative. Based on the level of pre-screening of the operational management program and the economic feasibility endorsed by the sponsors––City X, Y State and Z Government––it is assumed the national government would be willing to co-finance the program. The other sources of funding may be local and international private subscribers and/or local banks by the way of distributing shares or “bond” financing.

Step I: Y State arranges terms of an interest-bearing loan from the (national) Z Government on behalf of City X.

Step II: Creation of an autonomous board that will be in charge of overseeing the development of the mass transit system. The responsibilities of the board will include the following: 1. Creating a mass transit corporation. 2. Selecting a foreign supplier, and/or constructor, and/or technical manager as well as negotiating the essential terms of the scheme, including the offset package. 3. Taking indirect delivery of the basket of tradable commodities, which, in actuality, will be traded through the hand-picked partner or partners of the supplier/constructor/technical manager or, alternatively, through a compensatory trade manager who is diversified enough to also take the responsibility of executing the scheme. 4. Selecting and appointing the management team that will handle day-to-day operations. 5. Overseeing the performance of the management team after implementation, etc.

Step III: Implementation of mass transit scheme as well as offset requirement, which ideally, would be industrial projects that are oriented to the production of frequently needed replacement parts as well as tourist-related private investments with as much as $1 billion to $1.5 billion dollars in foreign (direct) equity contribution or between 50% to 75% percent of the total value of the contract.

Step IV: Commencement of mass transit operations and repayment of Z Government loan. See Model of transaction.

A parallel to this program involving more than one country will be explored in a future post on “Multinational compensatory trade arrangement”. Executable programs under this concept vary widely and depend on the availability of marketable commodities and manufactured or processed products as well as the creative capacity of key administrators in the various countries.